While this approach provides a straightforward valuation, it may not fully capture the market dynamics or the income potential of the asset. It is most effective when applied to assets with readily ascertainable costs and limited variability in replacement expenses. The market approach relies on comparable market data to determine an asset’s value. This method involves evaluating similar assets that have been recently sold.

Exchanging Common Stock for Services

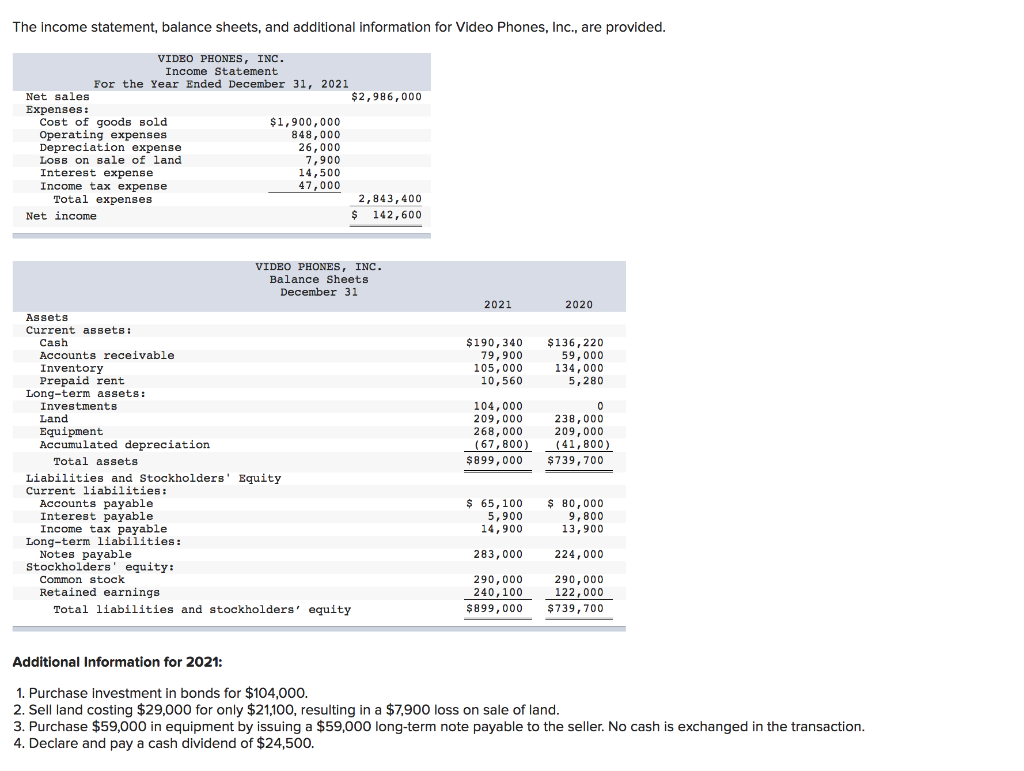

From these examples, it is easy to see that non-cash activities can significantly affect a company’s capital composition. As a result, once a significant non-cash transaction is involved, a company must disclose this transaction in its cash flow statement. It can do so either in a separate note or in a supplementary schedule. Stock is an ownership share in an entity, representing a claim against its assets and profits. The owner of stock is entitled to a proportionate share of any dividends declared by an entity’s board of directors, as well as to any residual assets if the entity is liquidated or sold.

- The transaction will require a debit to the Paid-in Capital from Treasury Stock account to the extent of the balance.

- Once the company determines the fair market value of the asset and shares, the accounting entry for the transaction is a simple one.

- Under normal circumstances, both parties cannot avoid the contract on the given date.

- This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

The Sale of Stock for Cash

These non-cash activities may include depreciation and amortization, as well as obsolescence. These items are taken on the income statement in small increments called depreciation or amortization. As an example of a stock transaction, suppose that a company issues 1,000 shares of $5 par common stock to obtain an asset worth around $12,000. Non-quoted companies can also issue new shares in exchange for cash or any other asset from new investors.

9: Non-Cash Activities

Record the amount of cash received as a debit to the Cash account. There are three main types of stock transactions, which are the sale of stock for cash, stock issued in exchange for non-cash assets or services, and the repurchase of stock. We will address the accounting for each of these stock transactions below. Depreciation and amortization, while more straightforward, still require careful consideration. These non-cash expenses are systematically allocated over the useful lives of the respective assets, adhering to the matching principle in accounting.

For example, say a manufacturing business called company A forks out $200,000 for a new piece of high-tech equipment to help boost production. The new machinery is expected to last 10 years, so company A’s accountants advise spreading the cost over the entire period of its useful life, rather than expensing it all in one big hit. They also factor tax season gifts in that the equipment has a salvage value, the amount it will be worth after 10 years, of $30,000. For this reason, if you plan to use the stock’s value as the measurement, it should be modified to reflect the issuance costs. If the stock is sold on the market, the net inflow would be less than $11.50 per share due to brokerage and legal fees.

Reporting Treasury Stock for Nestlé Holdings Group

Company XYZ owns a car which has cost of $ 50,000 and accumulated depreciation of $ 20,000. Management estimate there is no commercial substance related to this transaction. Cash and cash equivalents are those items on the balance sheet that are liquid assets. If the stock’s market value is uncertain, advocates of the “value given up” approach substitute the value received by the corporation as a best approximation. Non-cash transactions- the term in itself is quite indicative that it is the opposite of cash transaction.

Suppose a company ABC repurchases its 50,000 shares trading at $ 20 per share. Click here to extend your session to continue reading our licensed content, if not, you will be automatically logged off. As both assets do not have fair value, there is no commercial substance related to the transaction.

In which there may not be a movement in terms of cash or May the movement takes place in later time or no movement at all. So, to give a more accurate picture to their current financial condition, non-cash transaction effects are also added. A business transaction (selling or buying a thing) that does not involve cash is called non-cash transaction. It is an economic event that occurs when a company do a financing related transactions without being cash engaged into it. In these types of transactions, sometimes the company writes a promissory note instead of using cash. Explore the types, accounting practices, and financial impacts of non-cash transactions in this comprehensive guide.

Stock can be issued in exchange for cash, property, or services provided to the corporation. For example, an investor could give a delivery truck in exchange for a company’s stock. Another investor could provide legal fees in exchange for stock. The general rule is to recognize the assets received in exchange for stock at the asset’s fair market value.