Efficient bookkeeping involves foresight, meaning that a business should always plan for upcoming financial events, including tax time. Good preparation and documentation are critical for paying taxes (including payroll taxes) on time. When you first begin the bookkeeping journey, collect everything you have that could be relevant to establishing financial history. The information you get from your receipts should go into some kind of ledger (usually a digital option). This ledger acts as a tool to summarize your business’s overall financial performance and should include revenues, business expenses, and any other financial information your company chooses to keep track of.

Essential Financial Reporting Documents

Yet another approach is for the franchisee to be directly involved in the development process, with the oversight of the franchisor. This approach increases the risk of failure, since the location of the unit is untested. A final possibility is for a pre-existing, independent business to enter into a franchisee relationship, where it agrees to operate under the logo of the franchisor. In this last case, the franchisee already knows that the selected location will succeed, since it’s already been in operation for some time. In the rare event of errors or discrepancies, we will promptly identify and rectify them, working diligently to maintain accurate financial records for your franchise.

Even if you decide to outsource your books to an accountant, payroll for accountants could drastically decrease the financial burden on your overhead. Investing in a bookkeeping franchise can be a lucrative opportunity for entrepreneurs interested in the financial services industry. The franchise business model provides a proven system for success, and the demand for bookkeeping services is expected to continue to grow. These are services you can offer yourself or refer in exchange for a percentage of proceeds. We work with each of our tax preparation franchise owners to make sure they understand how to run their tax preparation business and also secure additional profits.

TaxAssist Accountants

Goldfish Swim School, founded in 2006 by Jenny and Chris McCuiston, offers swimming lessons for children aged 4 months to 12 years, equipping them with essential life-saving and life-changing skills. Since franchising began in 2008 to meet growing demand, the Goldfish Swim School franchise has expanded to numerous locations across the United States and Canada. Starting a Goldfish Swim School franchise presents an exciting opportunity, particularly for those passionate about making a difference in children’s lives and fostering confidence.

If you are accepted as a NTC Exclusive Agent, we will train, certify and support you for the life of your business. If you are ready to be your own boss, take charge of your life, and start living your dream of being in business for yourself, Roni Deutch Tax Center franchise is an excellent choice. The Roni Deutch Tax Center franchise system is part of a billion dollar industry that has consistently withstood changes in the economy.

Tips for Small Business Bookkeeping

With franchise sales just kicking off, it’s the Office Squad’s goal to change the way small businesses grow. They offer their clients bookkeeping along with other administrative services such as phone answering, virtual offices, and executive suites. But they also take things further by recommending new systems and procedures to help small and medium-sized businesses grow.

I have multiple companies that xendoo handles the bookkeeping for and I wouldn’t have it any other way. Come see how BooXkeeping is shaking up the franchising scene at the 2024 IFA Convention! Explore our game-changing bookkeeping solutions that fuel growth and stability. Mathnasium is North America’s leading math-only supplemental education franchise. Its founder, Larry Martinek, spent three decades developing methods and materials to help give grade-school children a better foundation in math.

Fill out the form to get started.

The franchisor provides training and support, but the accounting process is entirely managed by the franchisee. This model is suitable for those who want more control over their business finances. For many franchise owners, bookkeeping is the most complex part of business operations.

It’s important to stay updated on changes in tax laws that may impact the franchise business. This involves monitoring updates from tax authorities and engaging the services of tax professionals to ensure compliance with tax laws and regulations. Managing the finances of a single-unit franchise can be challenging, as the franchisee has to handle all the accounting tasks independently.

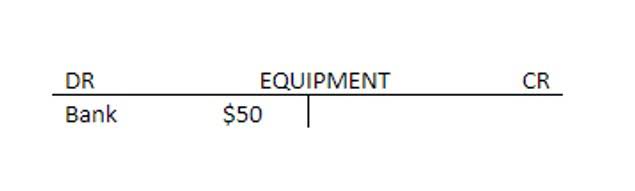

Double-entry bookkeeping

One of the franchise opportunities is to open a new retail office located in a specific franchise area. Managing the finances of a master franchise can be complex, as the franchisee has to oversee the accounting process for multiple franchisees. However, this model provides a significant bookkeeping for franchisees opportunity for growth and expansion, as the franchisee can benefit from the revenue generated by multiple franchise units. The master franchisee can also provide support and guidance to the franchisees in managing their finances, ensuring consistency and accuracy in financial reporting.